Our Risk Management Methodology

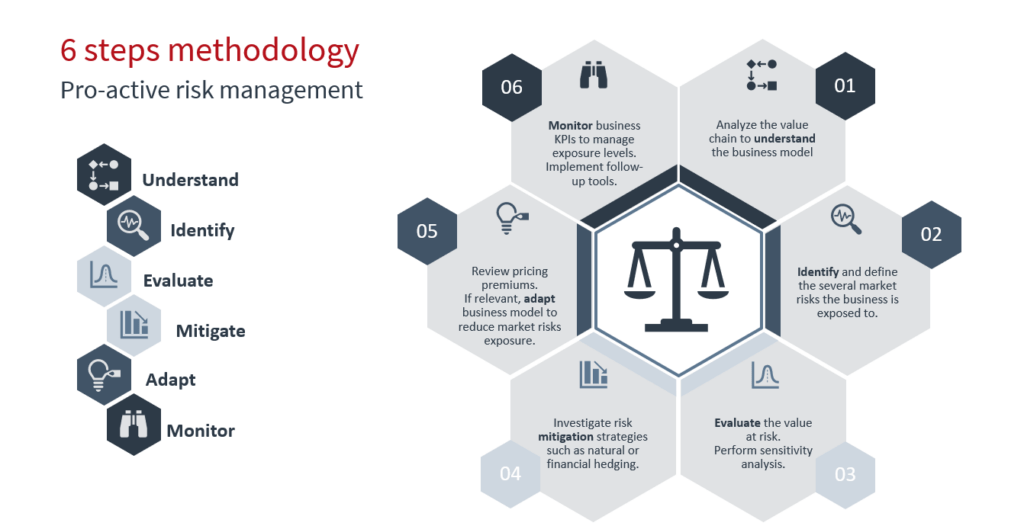

Most low-margin businesses with a high amount of their costs related to commodity sourcing are very aware of this. Geopolitically challenged periods often lead to volatile markets, within which many risks will materialize. Once the dust settles, financial reckoning starts and businesses estimate their losses. Furthermore, they will try to adapt their risk premiums to be better covered in the future. This approach, while applicable to markets with large margins and added value, is only reactive and does not ask the right questions. What risks am I exposed to? Can I reduce or control them? Is my business model sustainable in a volatile market? To answer these questions, irex consulting implemented a transparent, replicable and proactive six steps risk management methodology.

Replicable and proactive six steps methodology

A risk management project starts with a high-level analysis of the value-chain mechanisms. Identifying the stakeholders, financial flows and impacting factors will provide a clear understanding of the business ‘model’ which is critical for further deep dive into risk management Once the above overview is well defined, we can dig deeper into technical analysis and list market risks the business is exposed to. To identify those, we will need to isolate the processes interacting with the market or having an impact on market exposure, e.g. new demand coming in. For each identified process, we can define and categorise the risk depending on the impacting factors. The two first steps of our process require market experience to dive into business flows and understand the risks associated with the business model.

Once the risks are clearly identified, we can focus on getting the most out of the available data, with both historical and forward analysis. For each of the identified risks, analysts can isolate the realised financial impact in the past data, and compare it to current risk premiums used in pricing. Then, they will generate multiple stochastic scenarios to predict the expected future risk. To mitigate these risks, market players must reduce their exposure to market volatility. They don’t have to limit themselves to the usual future market products but also have access to a whole range of financial tools, such as derivative products and insurances, or can use more strategic solutions such as vertical integration. The third and fourth steps, therefore, require both data analysis and quantitative modelling skills to evaluate the risks and pick the optimal mitigation strategy.

If mitigation methods are not enough to get your risks to an acceptable level, you can use more structural solutions, from reviewing the risk premiums or the pricing methodology. Performing such core change requires taking a fresh and critical look at the current ways of working, and questioning each product in the portfolio to see if they are both relevant and profitable.

Finally, once all actions have been taken to put the risks under control, it is essential to implement follow-up tools to monitor the risk KPIs and get alerted if some risk value reaches the pre-defined threshold. Continuous monitoring is key to make sure the solutions implemented are producing the expected results and to know when a new action is required. Risk management is not a one-shot project but rather a continuous feedback loop, between taking actions and monitoring results.

Risk management is not a one-shot project

Strong of our experience in the energy sector, irex team, can provide all the necessary experts to help your business along its risk management journey, from market experts to project managers, including data analysts and strategic advisors. Obviously, every case does not require all six steps to be performed, but our methodology provides a clear framework to tackle projects with a structured and holistic approach.

You can find different projects where we implemented this methodology:

- Develop pricing & risk management Saas

- Review of pricing risk premium

- Setting-up exposure reporting